Having a Certificates of Insurance coverage is crucial as a enterprise proprietor.

However what’s a COI (and the way do you learn it)?

If you’re a small enterprise proprietor, you might be most likely conscious that you just want a Certificates of Insurance coverage (COI).

You might need been requested to offer one by a savvy shopper or potential landlord. Or maybe your unbiased insurance coverage agent suggested that you’ve got one.

Or you could not have the slightest clue what it’s.

As Central Florida-based unbiased insurance coverage brokers, we not solely know what a Certificates of Insurance coverage is, however we’re additionally used to answering questions on them. Let’s reply a few of your prime questions on your Certificates of Insurance coverage.

In the event you’ve ever puzzled “What’s a COI?” or “What do all these numbers and letters imply?” enable us to shed some mild on this necessary doc.

What’s a COI?

A Certificates of Insurance coverage (COI) is a doc that serves as proof of enterprise insurance coverage protection. Additionally it is often called a Certificates of Legal responsibility Insurance coverage, or proof of insurance coverage protection.

Issued by your insurance coverage supplier, your COI supplies a snapshot of your coverage on the time it was issued, detailing protection varieties, limits, and policyholder data. Whereas not an precise coverage, a COI is a standardized doc—sometimes primarily based on ACORD templates—used to exhibit protection to shoppers, distributors, or regulatory authorities.

As a enterprise proprietor or unbiased contractor, you possibly can request a COI for a number of forms of enterprise insurance coverage—basic legal responsibility insurance coverage, enterprise insurance coverage, auto insurance coverage, and extra.

Why You Want a Certificates of Insurance coverage

So in case your COI is just not your coverage, why do you want a certificates in any respect?

When a shopper requests a COI, they’re asking for validation that what you are promoting is correctly insured. Your Certificates of Insurance coverage acts like a letter of advice out of your insurance coverage firm—full with its stamp of approval. As a small enterprise proprietor, it exhibits potential shoppers that you’ve got the correct insurance coverage protection, and it supplies monetary safety within the case of an incident together with your shopper.

With out it, any shady contractor may lie about having basic legal responsibility protection to keep away from paying hefty premiums. As you may guess, this might get extraordinarily messy within the occasion they trigger damage or property injury.

The best way to Learn Your Certificates of Insurance coverage

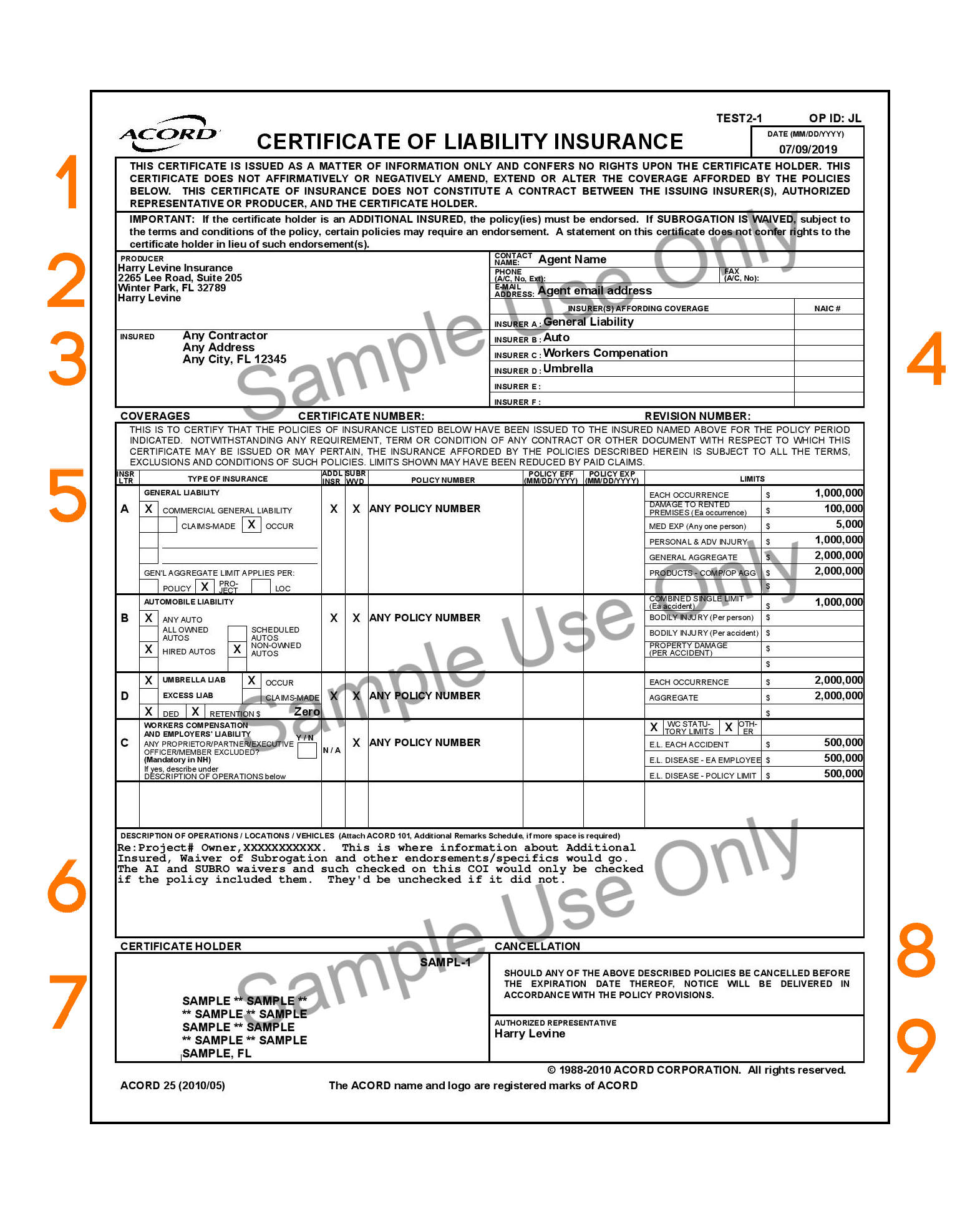

There may be numerous data included in your COI, but it surely’s not as difficult to decipher as it might appear. Your Certificates of Insurance coverage may be damaged down into 9 predominant sections and every of those sections has a special, but essential, objective.

1. Disclaimer

The disclaimer states that the Certificates of Insurance coverage is merely a illustration of your present protection and doesn’t “amend, prolong, or alter” your insurance policies.

2. Producer

This part will record the identify and handle of the insurance coverage agent or dealer who issued your COI.

3. Insured

The authorized identify and handle of the individual or firm lined underneath the insurance coverage insurance policies described on the COI.

4. Insurers Affording Protection

This part will record all the insurance coverage firms that the Insured has insurance policies underneath. They’re listed A by way of F.

5. Coverages

Your “Coverages” part is the longest, as that is the place you will discover all the particulars of what you are promoting insurance coverage protection, together with insurance coverage kind, efficient dates, and limits. This space is the place COIs are inclined to get just a little complicated, so let’s break it down.

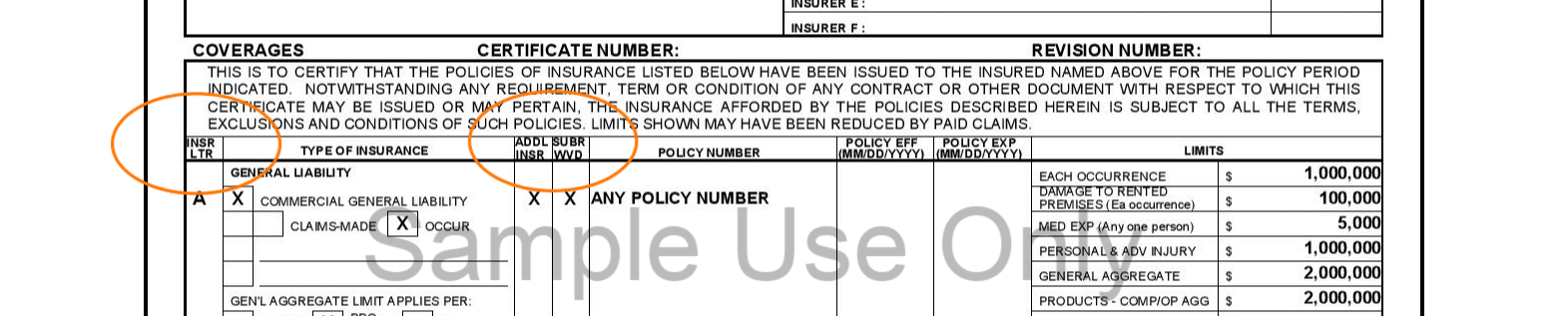

On the far proper, you’ll see a column labeled “INSR LTR.” That is quick for “Insurer Letter”; the letter you see right here will correspond to the Insurer Affording Protection as described earlier.

As an example, if there’s a “B” on this column, it implies that the insurance coverage firm holding that individual coverage is identical insurance coverage firm listed subsequent to “B” within the “Insurers Affording Protection” part.

“Kind of Insurance coverage” refers to the kind of protection afforded by coverage, whether or not safety in opposition to legal responsibility, auto or fleet protection, storage, extra, or employees compensation, and extra.

Subsequent you’ll see two columns labeled “ADD’L INSRD” and “SUBR WVD.” The primary one stands for “Further Insured,” and an X positioned on this column signifies that the individual being issued the Certificates is a further insured on the coverage.

“SUBR WVD” stands for “Subrogation Waived” and is a really essential a part of your Certificates of Insurance coverage, particularly if you’re offering this doc as a subcontractor. If the SUBR WVD field is checked off, that implies that the insurance coverage firm of the named insured won’t be able to pursue authorized motion in opposition to specified events that often embrace the Certificates Holder (see #7 above) within the occasion of a declare, even when they have been straight chargeable for the damages.

Subsequent listed is the suitable coverage quantity, in addition to the efficient and expiration dates of the coverage. The final column exhibits the bounds (in {dollars}).

6. Description of Operations

If there are any particular operations, areas, or tasks that the Certificates of Insurance coverage applies to, they are going to be listed right here. That is additionally the place the COI would record details about any Further Insured or Subrogation Waiver.

7. Certificates Holder

The identify and handle of whoever is requesting the Certificates of Insurance coverage. In some instances, this can be the enterprise itself; in different instances, it might be their shopper or one other establishment.

8. Cancellation

That is one other disclaimer that lists the variety of days that the insurance coverage firm will ship discover to the Certificates Holder within the occasion that any of the insurance policies are canceled earlier than the expiration date listed. Thirty days is customary.

9. Licensed Consultant

Your Certificates of Insurance coverage should embrace the signature of your insurance coverage agent/dealer or a consultant of the company.

For extra data on insurance coverage phrases you must know, examine our information right here.

Get Your Certificates of Insurance coverage

Understanding your Certificates of Insurance coverage is a vital a part of proudly owning a small enterprise, but when your insurance coverage agent is simply telling you which ones coverages you at present have, you’re solely seeing a small piece of the puzzle.

Accidents, shoddy work, negligence, and different claims happen on a regular basis in business settings, which is why it’s necessary to have the fitting degree of insurance coverage to guard what you are promoting.

At Harry Levine Insurance coverage, we’ve been assembly Central Florida’s insurance coverage wants for greater than 30 years, and now we have the data, sources, and experience to establish and shut gaps in your protection.

In the event you’re searching for inexpensive protection that meets your wants, request a quote right now.