By Tasha Williams and Loretta Worters

Practices that foster pointless or drawn-out litigation are amongst a number of hard-to-measure forces that may shift loss ratios for insurers and disrupt forecasts, making value administration more difficult. Finally, the ensuing value enhance is handed on to customers, which adversely impacts the affordability and availability of protection. The Insurance coverage Info Institute (Triple-I) and Munich Re US revealed a brand new useful resource to assist customers perceive how authorized system abuse is fueling greater declare prices, driving up premiums, and lowering the effectivity of our civil justice system.

A Client Information: How Authorized System Abuse Impacts You explains, utilizing accessible language and interesting graphics, how parts of authorized system abuse – together with third-party litigation financing, persuasive jury anchoring, and the deluge of lawyer promoting – can distort outcomes and siphon worth away from injured events, policyholders, and the economic system.

“Authorized system abuse has pushed up litigation bills and prices, impacting companies and customers throughout america,” stated Joshua Hackett, Head of Casualty at Munich Re US. “If left unchecked, these rising prices will proceed to extend insurance coverage premiums and restrict protection choices.”

The patron information outlines authorized tendencies and quantifies the impression of authorized system abuse past rising premiums.

• $6,664 in added annual prices for the typical American household of 4

• 4.8 million U.S. jobs misplaced as a consequence of extreme litigation

• $160 billion in tort-related prices borne by small companies yearly

Who Advantages from Massive Settlements?

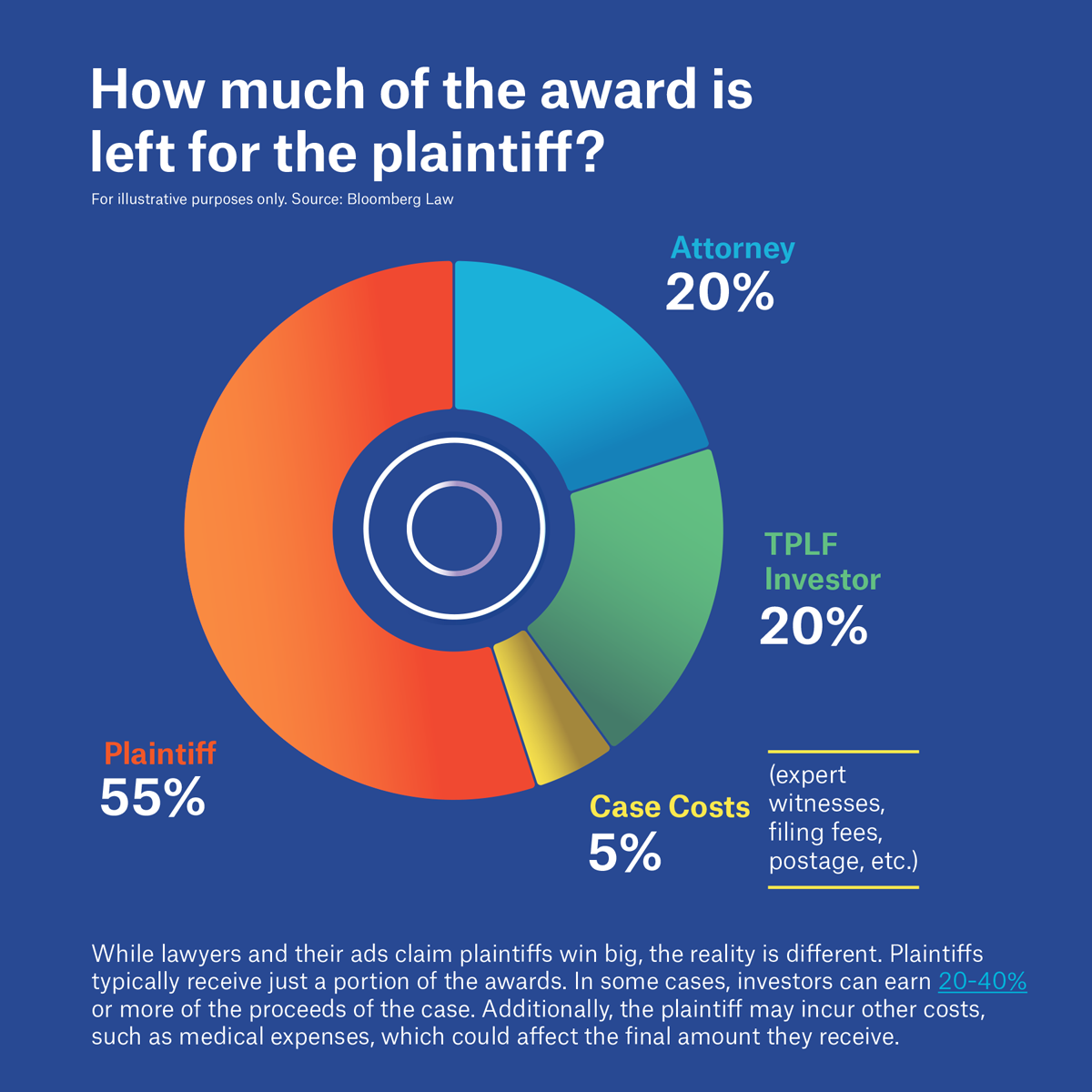

The narrative of authorized system abuse may be muddled by information of huge, high-profile settlements, which might indicate plaintiffs are successful large. In actuality, injured events usually find yourself with solely a fraction of their awarded damages after charges, obligations to third-party litigation funders, and inflated bills are taken under consideration.

In line with a latest report from Duane Morris Class Motion Evaluate, a protection lawyer curiosity group, $42 billion in school motion settlements was reached final yr, the third-highest worth the group has tallied over the previous twenty years. That determine included ten settlements of no less than $1 billion. Merchandise Legal responsibility Class Actions reaped by far the biggest quantity for a follow space, at $23.40 billion. Annual numbers for total settlements reported in 2023 and 2022 had been $51.4 billion and $60 billion, respectively.

Nevertheless, the majority of those settlements don’t finally profit the injured events. Attorneys can cost contingency charges starting from 33 to 40 p.c for his or her labor, plus bills incurred by litigation, similar to court docket prices and skilled witness charges. Moreover, the method for injured events to say and obtain their share of the settlement may be complicated and drawn out, and, usually, it isn’t well worth the small share quantities dispersed to most claimants in the long term. A 2019 Federal Commerce Fee examine estimates the median claims charge for shopper class motion settlements was 9 p.c and that the weighted imply — weighted by the dimensions of the category — was solely 4 p.c.

“Whereas billboard attorneys use exploitative commercials promising large greenback settlements, the reality is customers and enterprise homeowners may be left with much less cash, generally considerably much less, if third-party litigation financiers are concerned,” stated Triple-I CEO Sean Kevelighan.

The patron information reinforces what many danger and claims professionals are observing available in the market.

- Longer case durations

- Larger settlements and awards

- Diminishing predictability within the authorized setting

This erosion of predictability poses underwriting challenges and impacts the affordability and availability of protection, significantly in casualty and legal responsibility strains.

Authorized system abuse may be mitigated by supporting public consciousness and sturdy tort reform coverage.

Triple-I and Munich Re US are encouraging the trade to advocate for:

- Disclosure necessities for litigation financing

- Reforms to cut back medical billing abuse

- Extra oversight of lawyer promoting practices

The information serves as an academic software that insurers, brokers, and trade companions can share with shoppers and stakeholders to elucidate the hyperlink between premium will increase, different rising prices, and potential authorized publicity.

This collaboration between Triple-I and Munich Re US is a part of Triple-I’s multi-faceted consciousness marketing campaign to assist educate trade insiders, customers, and different stakeholders in regards to the challenges posed by authorized system abuse to protection affordability and availability. We invite you to study extra about authorized system abuse by studying our subject briefs, similar to “Authorized System Abuse: State of the Danger” and “Authorized System Abuse and Lawyer Promoting for Mass Litigation: State of the Danger,” and visiting our information hub on this subject. To hitch the dialogue, register for JIF 2025.