Bounce to winners | Bounce to methodology

Navigating a riskier world

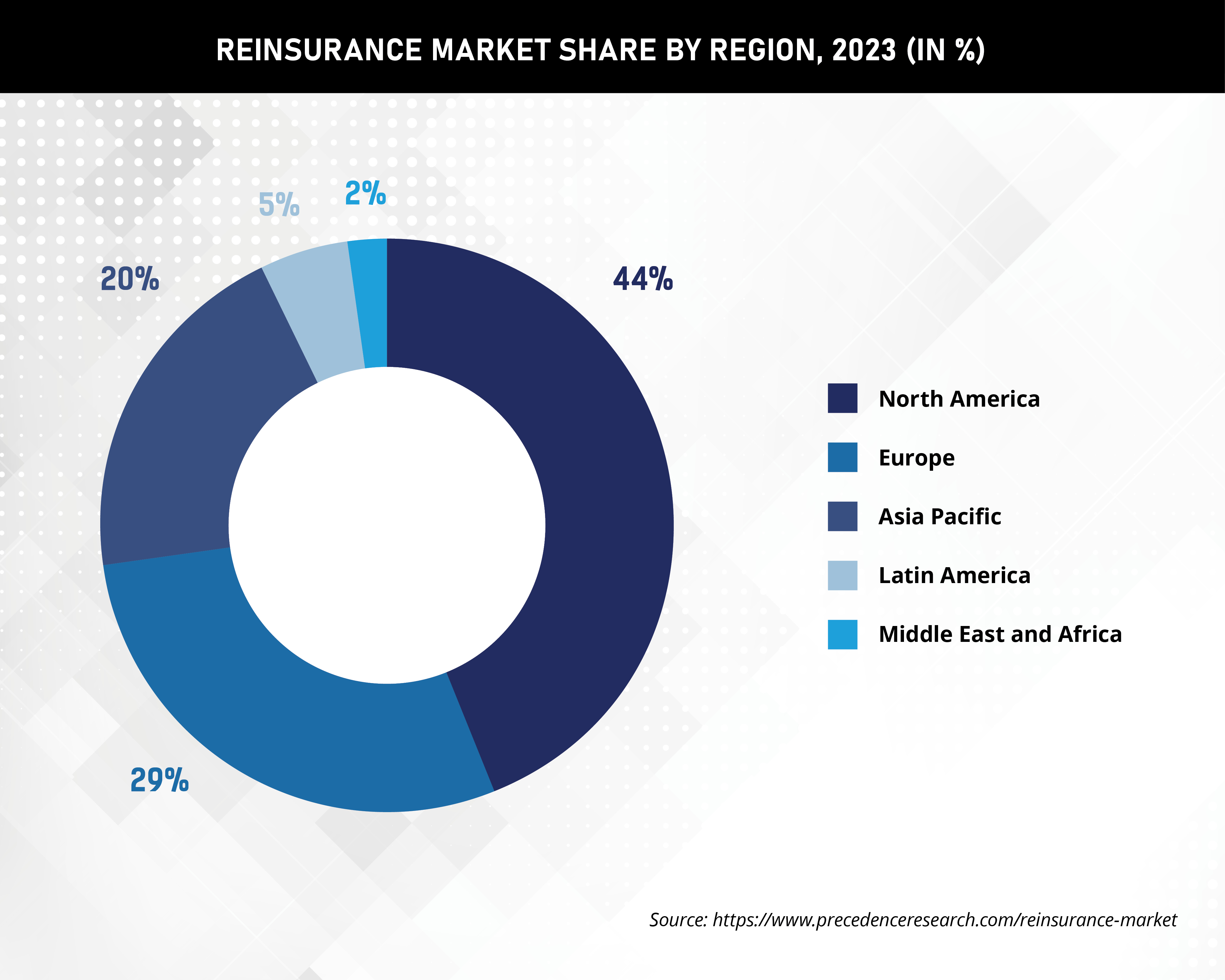

The reinsurance market has skilled a strong 12 months, demonstrated by Fitch Scores’ revision of its international reinsurance sector outlook to ‘impartial’ from ‘bettering,’ even because it feels the reinsurance pricing cycle has more than likely handed its peak.

The perfect underwriting circumstances in 20 years drove report income in 2023, with a optimistic trajectory persevering with into the beginning of 2024, testomony to the efficiency of these featured on this 12 months’s ReInsurance Enterprise Scorching Checklist, as they’ve been essential in guiding the sector via such a significant interval.

“Throughout the board, the market has change into particularly disciplined with limits administration and considerate attachment methods. In extra casualty, reinsurers are specializing in claims dealing with not simply in their very own layers however all through the tower, demanding high-quality engagement from each provider on a panel. And as at all times, markets proceed to emphasise the significance of underwriting self-discipline and proactive, clear dialogue with brokers and purchasers,” feedback Matt Moran, North America property and casualty underwriter for SiriusPoint.

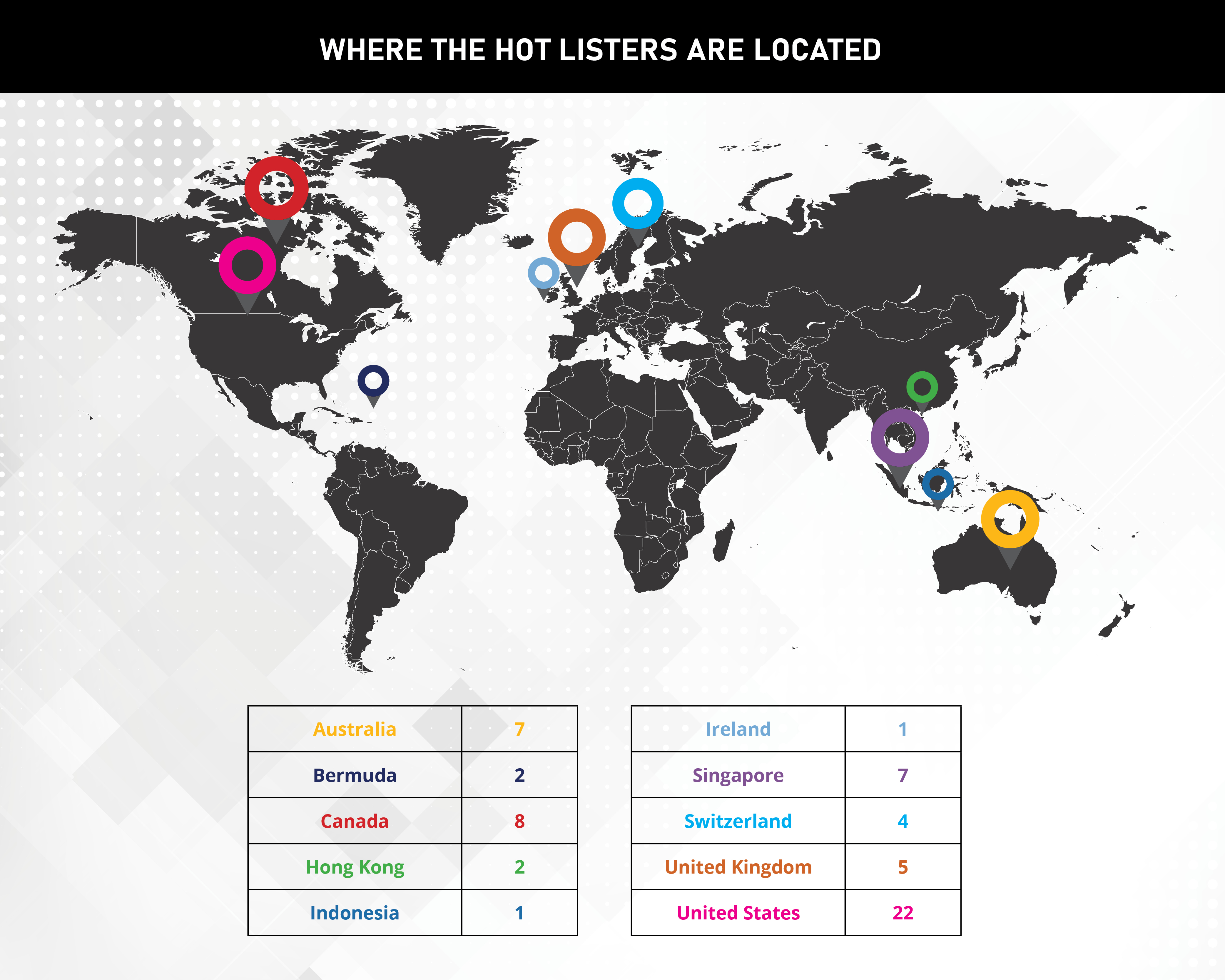

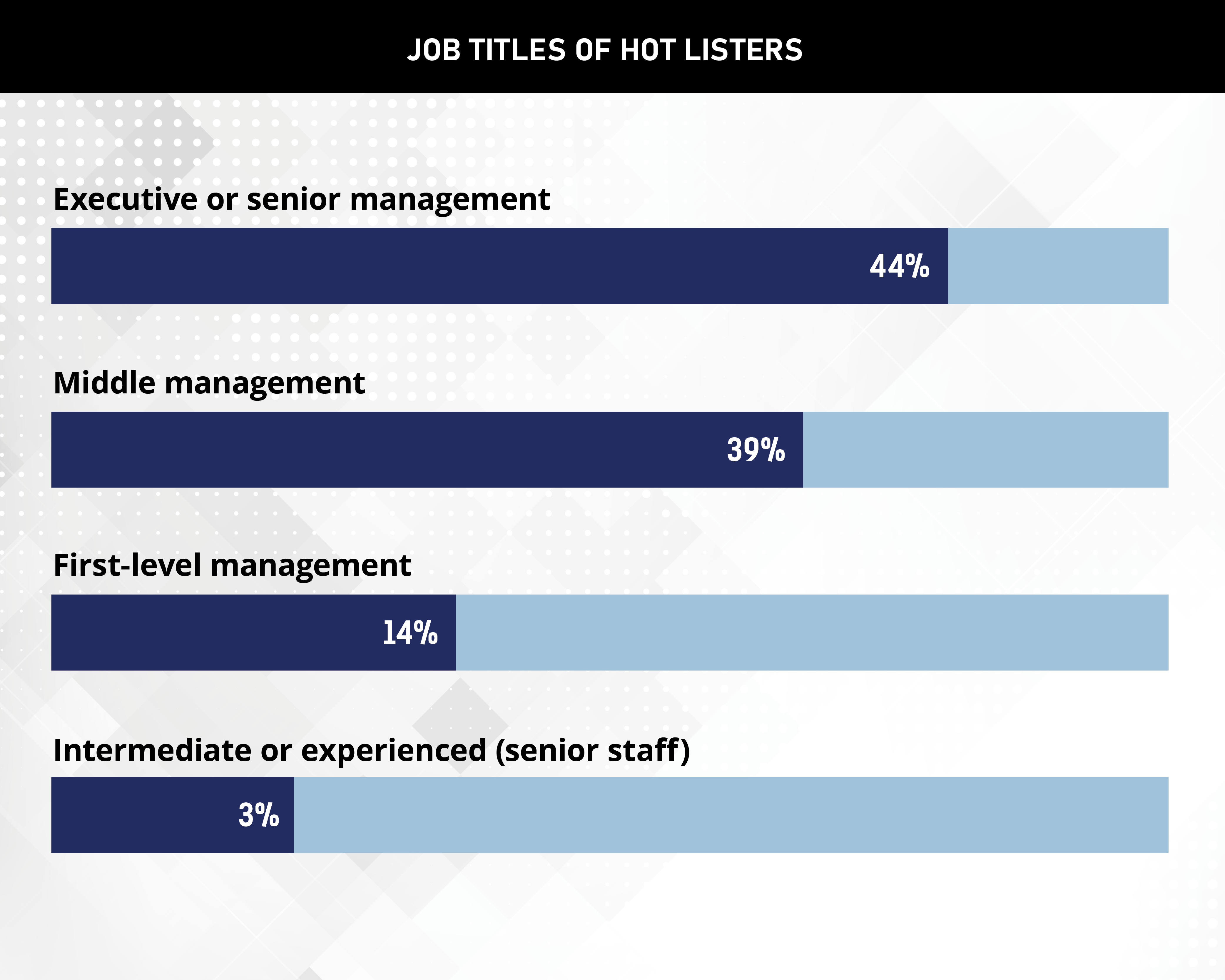

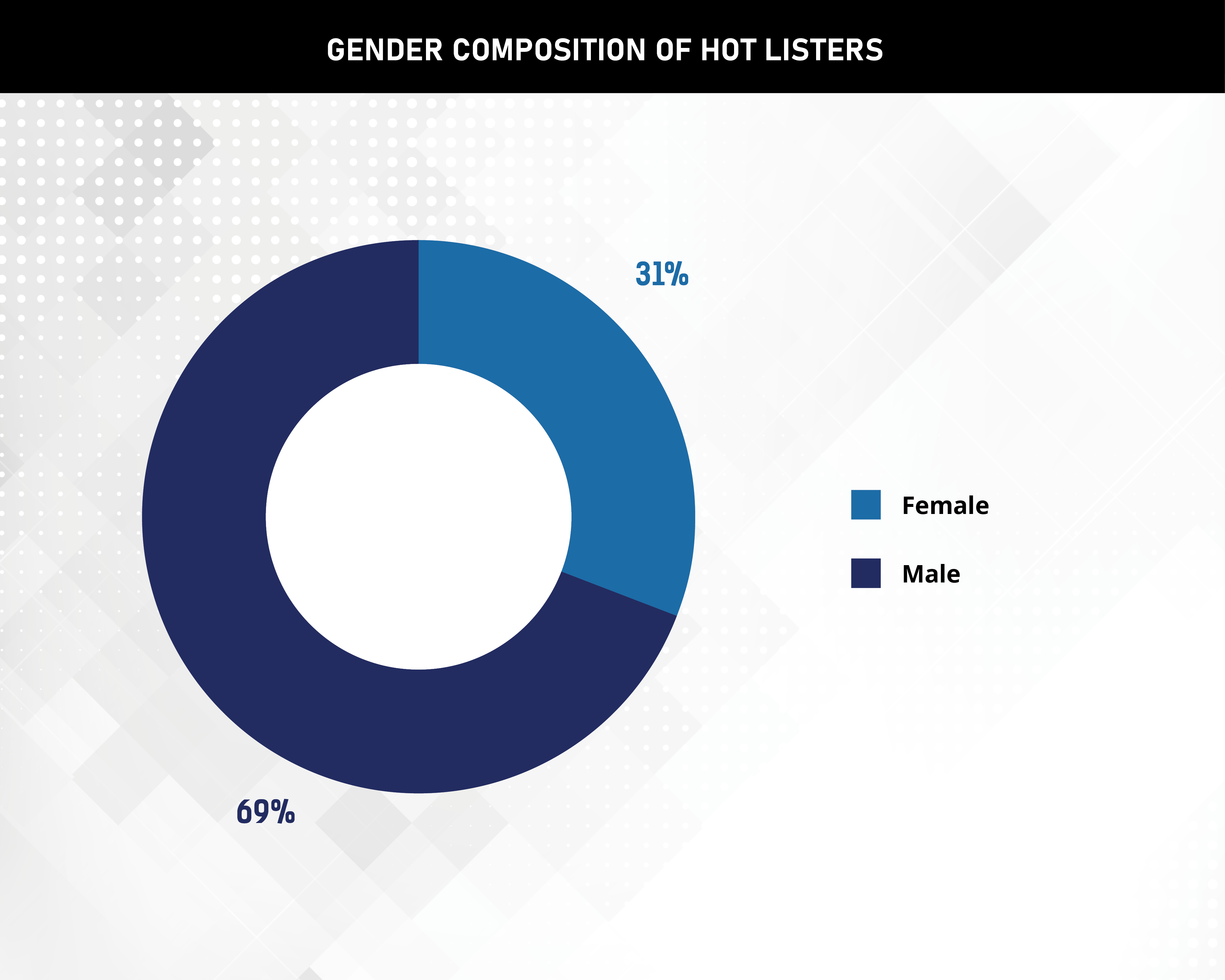

Whereas a whole lot of candidates had been thought of, 59 key figures had been chosen for his or her management, innovation, and trade contributions.

Their foresight has been essential in creating new merchandise and methods of sharing dangers to navigate the unsure panorama.

“Understanding the ins and outs of their facultative reinsurance technique is the primary driver of what we do. It’s essential be nimble and fast pondering to grasp what your consumer’s final purpose is, and with the ability to ship bespoke options in a fast-paced and ever-changing surroundings to fulfil their expectations is our best problem,” says Matt Nash, head of facultative, Asia Pacific at WTW.

Whereas Suzanne Williams-Charles, CEO of Bermuda Worldwide Lengthy Time period Insurers and Reinsurers (BILTIR), feedback, “In at present’s evolving reinsurance trade, the simplest leaders will perceive advanced dangers, have a dedication to innovation, and an acknowledgement of the necessity for alignment of each regulatory expectations and stakeholder wants,” she says. “Right this moment’s leaders ought to encourage proactive options and be open to incorporating technological options into their course of. New longevity-focused reinsurance options permit main insurers to handle liabilities and supply extra strong pension and retirement options.”

The professionals named on the celebrated Scorching Checklist have grappled with at present’s consistently altering danger surroundings, the tempo of which has accelerated in all traces of enterprise, in line with Clarisse Kopff, who leads European and Latin American reinsurance at Munich Re.

The rise in danger is break up throughout property, casualty, and specialty.

-

Property noticed a rise in each the frequency and severity of pure occasions, leading to an roughly 10 % improve in demand throughout the market, which was nicely met by reinsurers. Notable incidents included Hurricanes Otis and Milton, together with the Noto Peninsula earthquake. The market trajectory has seen renewals proceed to be extra competitively priced as insurers have excessive expectations for reinsurers assembly deadlines for quoting and clear authorizations in a constant method. Tracy Hatlestad, head of property reinsurance at Aon, says, “Responsiveness to particular person cedent’s priorities will probably be a key indicator to insurers of the extent of dedication {that a} reinsurer brings to the renewal course of.”

-

Casualty has been dealing with giant swings in inflation and rates of interest. Swiss Re’s newest sigma market briefing detailed how legal responsibility claims prices are rising sooner than the speed of financial inflation in a number of main economies and exhibiting no indicators of abating. To additional compound issues, 77 % of jurors within the US consider in using punitive damages to “punish a company”. Citing a 2023 behavioral economics survey, Jerome Haegeli, group chief economist at Swiss Re, underscored revenue inequality as a key driver of this pattern, highlighting how 44 % of respondents felt corporations ought to pay medical compensation even when they aren’t accountable for an accident. For instance, 27 courtroom circumstances awarded greater than $100 million in compensation in opposition to business defendants previously 12 months.

-

Specialty has had a sequence of destabilizing elements and geopolitical occasions, resembling Russia’s continued invasion of Ukraine, the lack of a Japan Airways Airbus 350, the collapse of the Baltimore bridge, and historic flooding in Dubai. “Because the world continues to [face] extra geopolitical instability and financial uncertainty, we’re additionally seeing an elevated demand within the specialty reinsurance area,” says Jimmy Keime, head of engineering and nuclear at Swiss Re.

These challenges are underlined by head of reinsurance operations at Martello Re, Sherice Bashir, who provides, “The reinsurance area faces uncertainty in protection, pricing, and regulation underscored by the acute geopolitical and financial challenges. Local weather change considerations are linked to unprecedented frequency and severity of pure catastrophes in property and casualty reinsurance. There are additionally notable complexities in capital administration whereas producing yields and managing mortality dangers with the growth of life and annuity reinsurance.”

Cyber danger is one other main growth evidenced by the CrowdStrike/Home windows international outage. Reinsurers have been working nearer with their companions to assist firms and societies advance their cyber resilience. As well as, the trade is attempting to make sure a sustainable cyber insurance coverage market to cowl rising safety wants.

“Many carriers are taking a look at geographies, buyer segments, distribution fashions and different particular niches inside the marketplace for that development potential,” explains Chris Baddeley, VP of insurance coverage options at Envelop Danger. “And that’s in a way that we, as a crew, don’t really feel we’ve seen earlier than. Whether or not that’s European development, or Asia, or center market, or different distribution – these are among the themes we’re seeing rising as focal factors.”

What it takes to be an Influential Reinsurance Chief

The reinsurance trade is at a “important juncture,” in line with Aon’s Final Information to Reinsurance Renewal (September 2024) report, which describes how the sector is on a extra monetary strong footing. It additionally states that reinsurers should deepen their partnerships with insurers, use their capital to create a extra sustainable market, and lean right into a altering danger panorama.

Nash shares, “The companies of our purchasers are advanced and our worth comes from working within the grey area by supporting our purchasers to navigate via this journey. There would be the customary geography, social, and regulatory variations that professionals will face, however extra particular to our trade, there would be the challenges of managing individualized consumer methods throughout all areas.”

These are the initiatives pushed by these on ReIB’s Scorching Checklist and the important thing areas during which they’re excelling are:

-

Understanding demand: The demand for reinsurance is powerful attributable to publicity development, modeling modifications, and score company pressures, in addition to the necessity to handle more and more advanced dangers and volatility of enormous losses. Escalating cyber threats are additionally boosting the necessity for specialised reinsurance merchandise to react to classy cyberattacks.

-

Powering development: Aon believes the trade has untapped development potential. Regardless of publicity development and unmet buyer want, the worldwide insurance coverage premium-to-GDP ratio has hovered round 1.8 % since 2010. Penetration within the US has elevated since 2017, however remains to be beneath its all-time excessive of three.9 % again in 1987, whereas EMEA has seen a gradual decline because the early 2000s. The safety hole and the underpenetration of insurance coverage exhibit the massive alternatives for (re)insurers to develop in a sustainable and worthwhile means.

-

Directing funding: With the precise instruments, expertise and product growth is essential to staying related as an trade. Reinsurance must undertake a development mindset, with a long-term strategic plan, and primarily based on deeper collaboration. Warning over rising dangers is comprehensible, however a collective effort, with out the worry of failure, will allow product and repair innovation.

-

Environmental, social, and governance (ESG): Appreciating the elevated significance of ESG to create sustainable and socially accountable merchandise, matching consumer preferences and regulatory requirements.

Moran stresses how the highest reinsurance professionals have embraced the digital world.

“Globalization and technological change are quickly altering the danger panorama. The trendy web is barely 20 years outdated, and solely within the final 10 years have smartphones change into ubiquitous globally. On this context, a top-performing reinsurance skilled wants to remain curious, be taught rapidly, and nimbly apply danger fundamentals to novel conditions,” he shares. “In fact, that is all predicated by competence in finance and enterprise fundamentals, strong analytical expertise, and maybe most of all, efficient communication and networking.”

Most influential reinsurance professionals

The trade leaders on the 2024 Scorching Checklist are positioned across the globe, fulfilling a sequence of impactful roles. Showcasing the breadth of experience and management of the celebrated record of reinsurance professionals are three of this 12 months’s winners.

CEO of Entrance Avenue Re

Location: United States

He considerably superior the combination of reinsurtech, offering important reinsurance capability to insurance coverage carriers. This has enabled these carriers to serve a bigger buyer base whereas leveraging cutting-edge know-how to boost the whole insurance coverage worth chain, together with underwriting, distribution, and danger evaluation. This integration not solely bolsters the insurance coverage trade’s effectivity but additionally instantly advantages the general public by bettering entry to insurance coverage merchandise and streamlining the shopper expertise.

One notable achievement underneath Fong’s management contains the availability of reinsurance capital and capability to cedents. This help has been pivotal in serving to cedents meet market demand and develop their companies. Moreover, he has spearheaded the introduction of digital onboarding processes, considerably enhancing buyer expertise and satisfaction when buying and managing their insurance policies.

Because the CEO of Entrance Avenue Re, Fong has been instrumental in fostering international partnerships throughout North America and Asia. By bridging the relationships between insurance coverage, reinsurance, and know-how companions, he has addressed the market demand for revolutionary insurance coverage options and technological developments.

President of Captives Insure

Location: United States

Developed and launched the primary open distribution, turnkey captive reinsurance answer that gives choices for property, builders danger, WC, AL/APD, GL, GL/PL, XS/UMB, sellers open lot, PL, IM, and cargo coverages. This program permits for the inclusion of NATCAT, sponsored/reasonably priced habitational, and New York Labor Legislation protection. With the power to write down in all 50 states and in 160 different international locations, Reznicek wrote a net-new gross written premium (GWP) of $63.4 million previously 12 months.

With options returning wherever between 50 % and 85 % of GWP as reinsurance premium to the captives, these placements introduced roughly $41 million in mixed returns. Up to now, these accounts’ incurred loss ratio rests at lower than 10 %, with many captives already receiving a surplus of roughly 90 % of the retained reinsurance premium.

Reznicek’s work has been important to the success of many high-performing companies as they’re lastly capable of take part of their danger in the identical method as Fortune 500/International 1000 entities. This answer has been notably helpful as well-managed companies in distressed trades (resembling reasonably priced, multifamily, agriculture, and others) need to remedy the issue of ever-increasing insurance coverage premiums.

Govt Supervisor, Pricing and Engineering at IAG

Location: Australia

Alongside his crew, Conway has pioneered a classy Tier 1 platform that produces the pure peril and reinsurance pricing throughout the IAG Group of companies, Australasia’s largest insurer. This strategic answer went reside for buyer quotes on IAG’s largest manufacturers in each Australia and New Zealand over the past 12 months, with present API name volumes exceeding 300,000 per day.

By way of his management and deep experience, Conway has linked particular reinsurance buildings on to reside prospects’ quotes, enabling detailed value optimization with ensuing financial savings for purchasers. As a part of this platform, Conway and his crew constructed best-in-class pricing fashions throughout earthquake, flood, bushfire, tropical cyclone, storm and storm surge, and developed the reinsurance analytics operate for the Group.

He’s additionally a committee member of the Disaster and Reinsurance Symposium (CARS). Due to its profitable six-figure fund raised from sponsors, CARS hosted a free symposium bringing Australian MPs, trade practitioners, and scientific specialists collectively. With the aim of “constructing information for a powerful future,” the free attendance ensured that future expertise may attend and the format stimulated constructive debate to align the deep information swimming pools of trade and academia with politics to seek out options to among the nice challenges at present, together with local weather change.

What the longer term holds for the influential reinsurance leaders

These on the Scorching Checklist are poised to take care of their momentum because the market strikes right into a extra impartial state. WTW’s Nash highlights that a part of the problem will probably be coping with tech.

“Reinsurance professionals should adapt and push via the technological shift in firms, higher perceive their purchasers, and supply faster or extra informative information and options. That is what purchasers need and wish from us sooner or later,” he says.

Bringing all operations in-house will allow the trade to fulfill the rising want for reinsurance.

Nash provides, “The basic of facultative reinsurance being a lever to help portfolio administration will at all times be the identical. It’s how we ship on this that may make a distinction to the efficiency and consequence for purchasers.”

Whereas Bashir emphasizes the fixed calls for on prime reinsurance professionals.

“They continue to be apprised of trade traits and are aware of the impacts their function and group’s place available in the market,” she explains, “They’ve essential expertise to translate the complexities into sensible options to drive success but additionally work for organizations with sturdy management, which might establish and foster expertise whereas setting clear targets, problem expertise, and create alternatives for development.”

And for Williams-Charles regualtory modifications and the way they’re navigated will outline the success of reinsurance leaders.

“They want to pay attention to regulatory modifications, particularly as new dangers are being recognized via the trade’s innovation. As these new dangers are recognized, further regulatory necessities will probably be developed to deal with them, that means that managing the ever-changing regulatory surroundings throughout a number of geographies successfully will differentiate leaders.”

Australia

- Andrea Dry

Head of Shopper Underwriting, ANZ

Swiss Re - Andrew Davidson

Director, Shopper Markets, Australia and New Zealand

Swiss Re - Christopher Wallace

Chief Govt Officer

Australian Reinsurance Pool Company - Karl Marshall

Head of Advisory and Analytics, APAC

Howden Re - Mark Doepel

Accomplice

Sparke Helmore Legal professionals - Philip Conway

Govt Supervisor, Pricing and Engineering

IAG - Scott Hawkins

Managing Director

Munich Re

Bermuda

- Fiona Walden

Chief Underwriting Officer, Casualty & Specialty

RenaissanceRe - William Wharton

Head of Argo Insurance coverage

Argo Group

Canada

- Apundeep Lamba

Head of Reinsurance, Canada

Sompo Worldwide - Claire Myles

President

Reinsurance Administration Associates - Claudette Cantin

SVP, Chief Actuary and Chief Danger Officer

Munich Re - Isabelle Bouchard

Vice President, Group Reinsurance

Reinsurance Group of America - Jason Arbuckle

SVP and Chief Agent, Canada

Accomplice Re - Jeffrey Walpole

Chief Govt Officer

SCOR Canada Reinsurance - Peter Askew

President and CEO, Canada

Man Carpenter - Pierre Dionne

Director and Chief Agent, P&C

CCR Re

Hong Kong

- Carmony Wong

SVP, Southeast Asia Markets and Chief Govt Officer, Hong Kong

RGA Hong Kong - Victor Kuk

Chief Govt Officer

Swiss Re Asia

Indonesia

- Marguerita Silitonga

President Director

Aon Reinsurance Options in Indonesia

Eire

- Jim Williamson

Govt Vice President, Group Chief Working Officer

Everest Group

Singapore

- Ann Chua

Particular Adviser Asia, Reinsurance

AXA XL Reinsurance - Emma Loynes

CEO, Lloyd’s Asia and Nation Supervisor, Singapore

Lloyd’s - Eric Pooi

Managing Director

SCOR Asia Pacific - Francis Savari

Chief Govt Officer

UIB Asia - Kenrick Legislation

Regional CEO and Head of P&C Shopper Administration

Allianz SE Reinsurance Department Asia Pacific - Lauren Liang

International Head of Progress and Innovation

Swiss Re Reinsurance Options - Marc Haushofer

SVP Asia Pacific

Renaissance Re

Switzerland

- Lauren Kent

President, Worldwide Reinsurance

AXIS Capital - Melodie Vanderpuye

Govt Director

Howden Re - Steve Arora

Chief Govt Officer

Alpine Re - Urs Baertschi

CEO, P&C Reinsurance, Member of Group Govt Committee

Swiss Re

United Kingdom

- Ditte Deschars

Chair, EMEA

Gallagher Re - Harriet James

Senior Vice President, Head of Sustainability Technique

Renaissance Re - Ibrahim (Ibi) El Moghraby

Chief Working Officer

QBE Re - James Vickers

Chairman Worldwide, Reinsurance

Gallagher Re - Terrence McDowell

Managing Director

Howden Re

United States

- Aisling Jumper

VP, Head of International Underwriting Operations

TransRe - Andy Marcell

CEO, Danger Capital and CEO, Reinsurance Options

Aon Reinsurance Options - Brian Flasinski

CEO, Gallagher Re North America

Gallagher Re - Carlos Wong

Senior Director, International Reinsurance Scores

AM Finest Firm - Chris Dittman

Head of Florida Technique

Aon Reinsurance Options - Claude Yoder

Accomplice/International Head of Analytics

Lockton Re - Edison Fong, FSA, CFA, FCIA, MAAA, CERA

Chief Govt Officer

Entrance Avenue Re - Greta Hager

Chief Monetary Officer

Fortitude Re - Kai Talarek

Chief Progress and Optimization Officer

Fortitude Re - Lee Covington

President

Reinsurance Affiliation of America - Lee H. Vuu

Vice President, Reinsurance Claims

Argo Group - Mark Hansen

International Chief Working Officer

Gallagher Re - Nate Reznicek

President

Captives Insure - Nick Nudo

Senior Managing Director of Reinsurance

Aon - Phillipp Kusche

International Head of ILS and Capital Options

Howden Tiger - Renaud Guidée

CEO, Reinsurance

AXA XL - Robert Cristiano

Vice President, Surety and Credit score Worldwide

Everest Reinsurance Group - Ron Hamilton

SVP Americas and P&C Operations Chief

Swiss Re - Russell McGuire

Co-CEO

BMS Re - Shawn Lynch

International Head of Monetary Dangers

TransRe - Simon Hedley

Chief Govt Officer

Acrisure Re - Suzanne Holohan

Govt Vice President and Chief Actuary

TransRe