For a few years, the owners insurance coverage market operated as a comparatively steady and predictable sector in California. Adjustments had been incremental, and the market largely catered to established patterns of threat and pricing.

This stability, nonetheless, has been disrupted just lately, with dramatic shifts reshaping the panorama. The excess traces insurance coverage market has seen unprecedented exercise, and 2024 marks one more pivotal 12 months in its evolution.

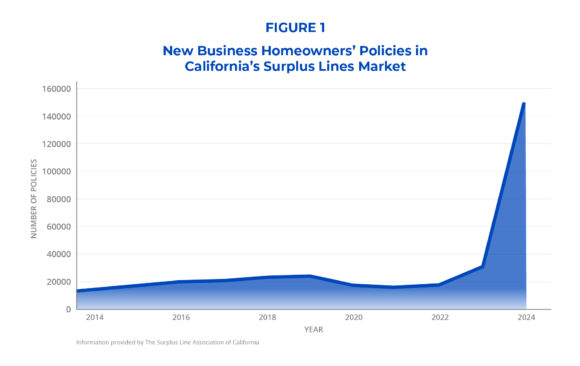

Constructing on the tendencies noticed in 2023, the excess traces market in California skilled outstanding progress in new enterprise in 2024. The annual variety of new enterprise insurance policies elevated dramatically, from about 31,000 in 2023 to greater than 150,000 in 2024—a staggering progress of 383% (Determine 1).

This sharp rise underscores the continued means of surplus traces carriers to fulfill the growing demand for owners insurance coverage protection left unaddressed by admitted carriers.

This progress displays an growth within the forms of properties at present being insured within the surplus traces market on account of admitted provider withdrawals. Not like admitted insurers, that are strictly regulated and topic to charge approvals, surplus traces insurers function with extra pricing flexibility, permitting them to insure dangers that conventional insurers decline to cowl.

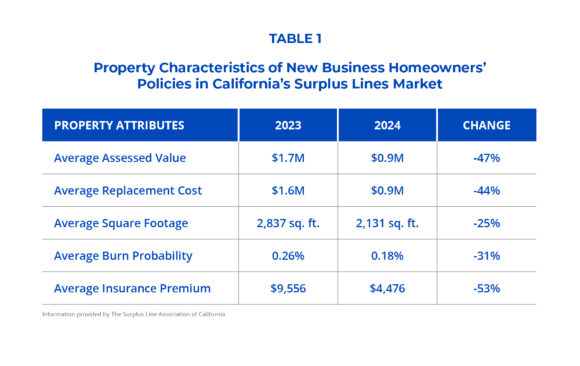

Traditionally, surplus traces owners insurance coverage insurance policies have been related to high-value, distinctive or high-risk properties, leading to bigger insurance coverage premiums, greater substitute prices and extra advanced underwriting necessities. Nonetheless, the information for 2024 paints a unique image, one which aligns extra carefully with the traits of insurance policies usually related to the admitted owners insurance coverage market.

Information collected utilizing e2Value and the U.S. Division of Agriculture highlights important modifications in key property traits for brand new enterprise insurance policies in California’s surplus traces market.

Assessed values for brand new enterprise insurance policies in 2024 averaged $0.9 million, a major lower of 47% in comparison with $1.7 million in 2023. Alternative prices skilled an analogous decline, dropping by 44%, from $1.6 million in 2023 to $0.9 million in 2024 (Desk 1). These reductions are substantial, indicating that the excess traces market is more and more insuring properties of decrease worth—properties which are much less advanced and had been as soon as comfortably inside the scope of admitted carriers.

The shift can be evident within the measurement of properties. The typical sq. footage of newly insured properties fell from 2,837 sq. toes in 2023 to 2,131 sq. toes in 2024, marking a 25% discount. Moreover, the common burn likelihood—a metric indicating the annual chance of a wildfire occurring at a particular location—has decreased by 31%, from 0.26% in 2023 to 0.18% in 2024 (see Desk 1). This decline means that the properties now getting into the excess traces market are in areas with decrease wildfire threat, reinforcing the notion that these insurance policies would have beforehand been positioned with admitted carriers.

On the identical time, insurance coverage premiums adopted an analogous trajectory, with the common premium for brand new enterprise insurance policies reducing by 53%, from $9,556 in 2023 to $4,476 in 2024 (Desk 1). These declining insurance coverage premiums replicate not solely lower-value properties but in addition shifting threat profiles that extra carefully align with the admitted market’s conventional scope. The convergence of smaller property sizes, decreased burn likelihood and decrease premiums additional helps the speculation that this progress is being pushed by insurance policies displaced from the admitted market.

The withdrawal of main admitted insurers, together with Allstate and State Farm, has created important protection gaps, pushing owners towards the excess traces market in its place. The properties now getting into the excess traces market replicate this shift, with considerably decrease sizes, assessed values, substitute prices, wildfire dangers and insurance coverage premiums—demonstrating the extent of admitted provider withdrawals and the market’s want for various options.

On the identical time, the inflow of historically admitted market–kind properties modifications the chance profiles of the excess traces market, requiring insurers to adapt their underwriting and pricing methods to accommodate this new actuality. The continued progress and evolution of the excess traces market in 2024 serves as a response to speedy market pressures, however long-term stability is dependent upon restoring steadiness inside the general insurance coverage system.

Gorshunov is an information scientist for The Surplus Line Affiliation of California.

Subjects

California

Householders

Considering Householders?

Get computerized alerts for this matter.