Background: What Drives Monetary Considerations Round Retirement?

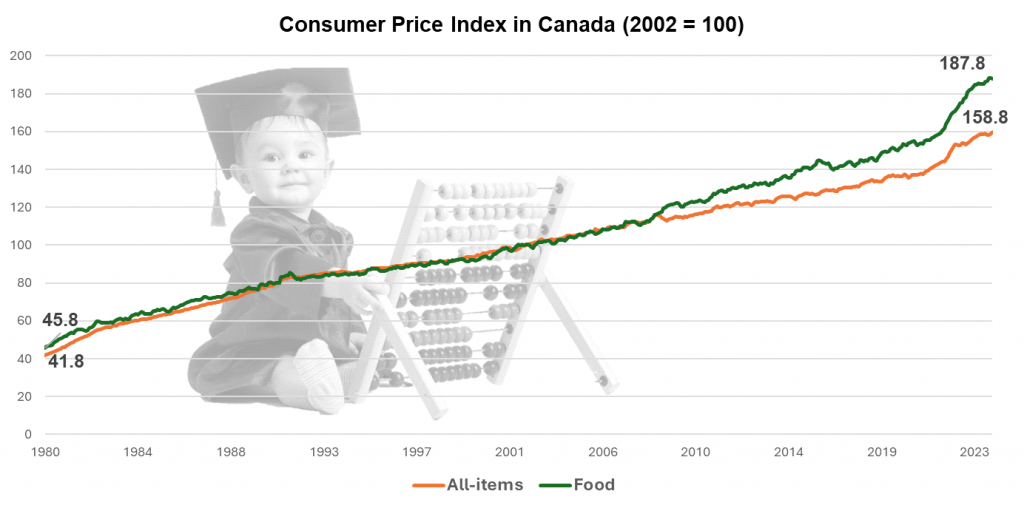

Regardless of hovering prices in Canada, particularly on the actual property facet, the incomes of Canadians haven’t grown quick sufficient to maintain tempo with the elevated price of dwelling. Each common and median incomes haven’t climbed as rapidly as the patron worth index (CPI).

This implies, the common wage grew solely by 50% and the median wage grew solely by 26% between 1980 and 2022, which leads to minimal progress year-over-year. Nonetheless, after we take a look at the event of the CPI, it climbed far quicker than salaries; rising nearly 400% between 1980 and 2023.

To place this in perspective, when a loaf of bread at Loblaws prices $3.99, because it averages now at Loblaws in 2024, it could have price a lot within the earlier years:

| 1980 | 1990 | 2000 | 2010 | 2020 | 2024 |

| $1.12 | $1.87 | $2.29 | $2.69 | $3.49 | $3.99 |

It means getting much less for the same sum of money, on condition that salaries haven’t elevated on the similar velocity.

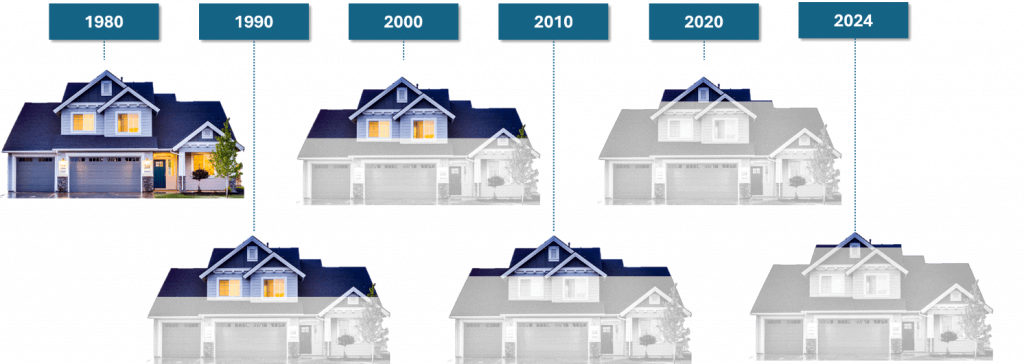

If we take a look at actual property costs, this growth turns into much more drastic, particularly in cities like Toronto and Vancouver. For instance, in 1980 the common worth of a Toronto property was $75,694. In 1990 – $255,000, in 2000 – $243,255. In 2010 it was $431,262 and in 2020 it was $939,636. In 2023 prices soared additional to $1,126,591.

On the similar time, life expectancy in Canada elevated from 75.1 years to 82.96 in 2023. This total statistic, although, is watered down by plenty of elements, together with those that have a diminished well being expectancy as a consequence of well being pre-conditions. What stands out is, at the moment 5 out of 10 Canadians aged 20 as we speak are anticipated to succeed in age 90, and 1 out of 10 is predicted to stay to 100 years of age.

It’s no marvel why Canadians are asking themselves if they are going to have the ability to afford an honest retirement in an setting the place they stay longer than ever, however salaries don’t climb as rapidly as client items costs and actual property prices.

How is This Retirement Article Totally different?

There are quite a few articles written on the subject of retirement and the way a lot cash you want. Most of them converge in direction of a easy “you want 70% of your pre-retirement earnings,” assertion, which is a most popular means for monetary advisors to plan however it doesn’t consider specifics of explicit conditions corresponding to when you hire or personal a home, when you want to gravitate in direction of a easy or extra luxurious way of life, and many others.

There are a number of themes we are going to cowl on this article. First, we talk about possible situations and for every of them, and we share a ballpark of how a lot cash you want. Subsequent, we are going to discuss in regards to the cash you want if you wish to retire at a selected age or at a selected wage. Lastly, we dive into insurance coverage merchandise corresponding to complete life insurance coverage, common life insurance coverage, time period life insurance coverage, crucial sickness insurance coverage that can make it easier to plan your retirement higher.

Our Strategy

|

So, let’s begin by stepping away from the usual 70% strategy and as a substitute develop an approximate schedule of funds that you could anticipate to pay throughout completely different classes corresponding to home, transportation, meals, hobbies, and holidays. For our train, we use the instance of any person who’s about to retire on the age of 64. Common life expectancy in Canada is at the moment 84 years however that could be a harmful quantity to plan for as this variability is pretty excessive; you don’t wish to run out of cash by that age. We use 94 as our higher reference quantity, that means that when you retire at 64, you have to be ready to financially cowl 30 years of your life on the model you’re contemplating. We added extra situations based mostly on two main elements:

|

Knowledgeable intro: Paul Foster Paul Foster is the Director of Investments, Japanese Canada, at Hub Monetary. He’s a extremely revered thought chief and skilled within the monetary companies trade, with over 25 years of expertise in monetary companies, investments, and insurance coverage. Previous to becoming a member of Hub Monetary, he held quite a few gross sales roles at Canada Life / Nice-West Life. He additionally spent a major period of time as a monetary advisor with Manulife Securities and BMO Nesbitt Burns. Paul accomplished his BA in Political Science on the College of Windsor. |

So, let’s begin by stepping away from the usual 70% strategy and as a substitute develop an approximate schedule of funds that you could anticipate to pay throughout completely different classes corresponding to home, transportation, meals, hobbies, and holidays.

For our train, we use the instance of any person who’s about to retire on the age of 64. Common life expectancy in Canada is at the moment 84 years however that could be a harmful quantity to plan for as this variability is pretty excessive; you don’t wish to run out of cash by that age. We use 94 as our higher reference quantity, that means that when you retire at 64, you have to be ready to financially cowl 30 years of your life on the model you’re contemplating.

We added extra situations based mostly on two main elements:

- Having a mortgage versus a home that’s paid off, as it is a large price driver.

- The kind of retirement you’re gravitating in direction of – commonplace versus luxurious. Inside luxurious retirement we thought-about a number of holidays all year long, having a costlier automotive, and spending extra on groceries.

Knowledgeable intro: Paul Foster

Paul Foster is the Director of Investments, Japanese Canada, at Hub Monetary.

He’s a extremely revered thought chief and skilled within the monetary companies trade, with over 25 years of expertise in monetary companies, investments, and insurance coverage.

Previous to becoming a member of Hub Monetary, he held quite a few gross sales roles at Canada Life / Nice-West Life. He additionally spent a major period of time as a monetary advisor with Manulife Securities and BMO Nesbitt Burns.

Paul accomplished his BA in Political Science on the College of Windsor.

Every situation was calculated each WITH and WITHOUT authorities advantages corresponding to Canada Pension Plan (CPP) or Outdated Age Safety (OAS) funds. These advantages have been estimated utilizing the Canadian Retirement Revenue Calculator from the Authorities of Canada.

- This calculation doesn’t embrace any jobs or facet hustles you may be pursuing to enhance your money stream after retirement.

- We don’t contemplate any financial savings that you just may need amassed (e.g. RRSP, TFSAs, and many others.). When you have saved $1M all through your pre-retirement years, you want $1M much less as soon as you’re retired.

- We don’t contemplate further investments as you would wish to think about each the extra earnings stream from these investments and likewise the taxes related to them.

- When you have an extra stream of earnings via a pension/annuity, that might additionally change the equation in your favour.

- We do account for inflation utilizing 2.5% as an annual inflation marker.

- We don’t contemplate any further worth that is perhaps locked in your property that you may entry in several methods, e.g. HELOC, reverse mortgage, or downsizing or promoting your property.

State of affairs 1: Single Particular person Family

First, we take a look at the situation of retirement financial savings for a single individual each with and with out a mortgage. For that, we seek advice from a median mortgage ($469,000) and assume a time period of 20 years.

The vary that’s offered refers to retirement funds required for dwelling till the ages of 84 and 94.

Along with that, we differentiate between reasonable and opulent retirement dwelling the place we double bills in some classes (highlighted in pink within the desk beneath).

| Value classes | |

| Dwelling | • Mortgage • Home upkeep & different charges (e.g. rubbish) • House insurance coverage • Property taxes |

| Utilities | • Cable • Web • Hydro • Gasoline/Heating |

| Transportation | • Gasoline • Insurance coverage • Automotive upkeep • Automotive change (each 15 years) |

| Meals | • Groceries |

| Healthcare | • Primary healthcare bills |

| Attire | • Clothes • Footwear |

| Leisure |

Single Particular person Family With no Mortgage

If you happen to don’t have a mortgage to pay while you retire, that units you up for much decrease retirement prices. The principle dwelling-related prices that you’ll be chargeable for are:

- property taxes

- upkeep prices

- further charges (like rubbish charges)

- residence insurance coverage

On this case, your estimated retirement finances might look as follows:

Single Particular person Family with a Mortgage

Ought to you might have a substantial mortgage if you find yourself retiring, it’s essential to carry further prices. On this case, you’re including a median of $2,500/month to your retirement finances. Your estimated retirement finances might look as follows: between $2.2M and $2.9M for reasonable and opulent retirement kinds while you plan till the age of 85, and between $3.7M and $5.0M for reasonable and opulent retirement kinds while you plan till the age of 95.

It is smart to say that the monetary wants of any person who’s planning to remain a renter are considerably comparable as this individual won’t be paying off a mortgage however will spend a substantial sum of money in rental prices. Rental prices of ~$4,000/month will lead to numbers just like those above.

An individual with {a partially} paid mortgage may need further sources of money corresponding to unlocking worth in an already paid-off portion of the property (HELOC, reverse mortgage, full property sale, and many others.).

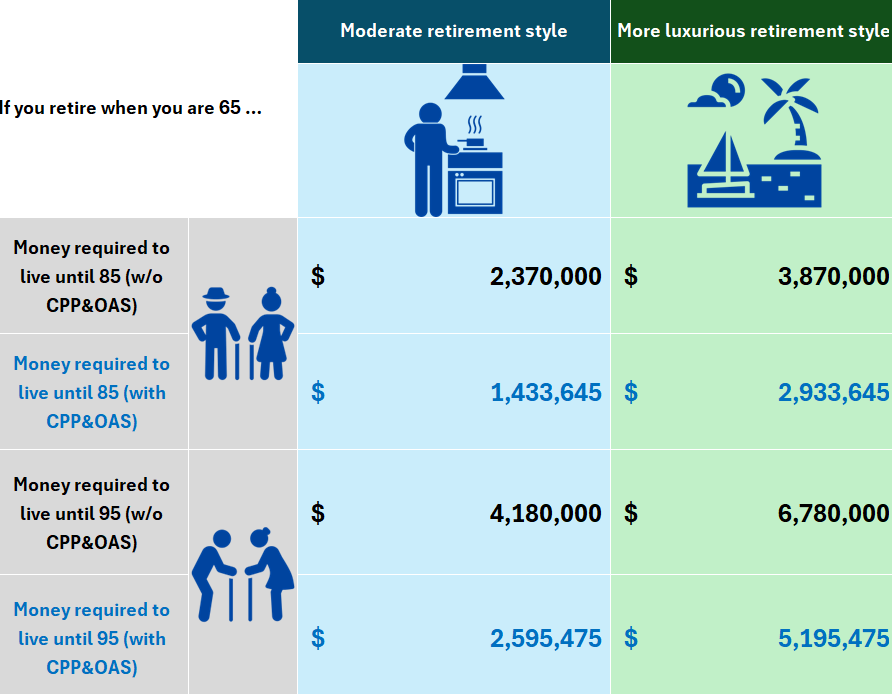

State of affairs 2: Two-person Family

On this situation, we take a look at retirement funds required for a family of two folks round retirement age. We assume that at this stage there aren’t any child-related bills as the youngsters have already grown up and are fully impartial.

We keep on with the identical mortgage, figuring out that these prices are unfold throughout two folks.

On the similar time, some prices like attire, holidays, and many others., are doubled (as famous within the desk beneath in pink) whereas others like meals are elevated by 75% (see the desk beneath in blue), realizing that there are some financial savings when dwelling collectively.

Please observe that that is solely an approximation.

| Value classes | |

| Dwelling | • Mortgage • Home upkeep & different charges (e.g. rubbish) • House insurance coverage • Property taxes |

| Utilities | • Cable • Web • Hydro • Gasoline/Heating |

| Transportation | • Automotive upkeep • Automotive change (each 15 years) • Gasoline • Automotive Insurance coverage |

| Meals | • Groceries |

| Healthcare | • Primary healthcare bills |

| Attire | • Clothes • Footwear |

| Leisure | • Hobbies • Holidays • Going out |

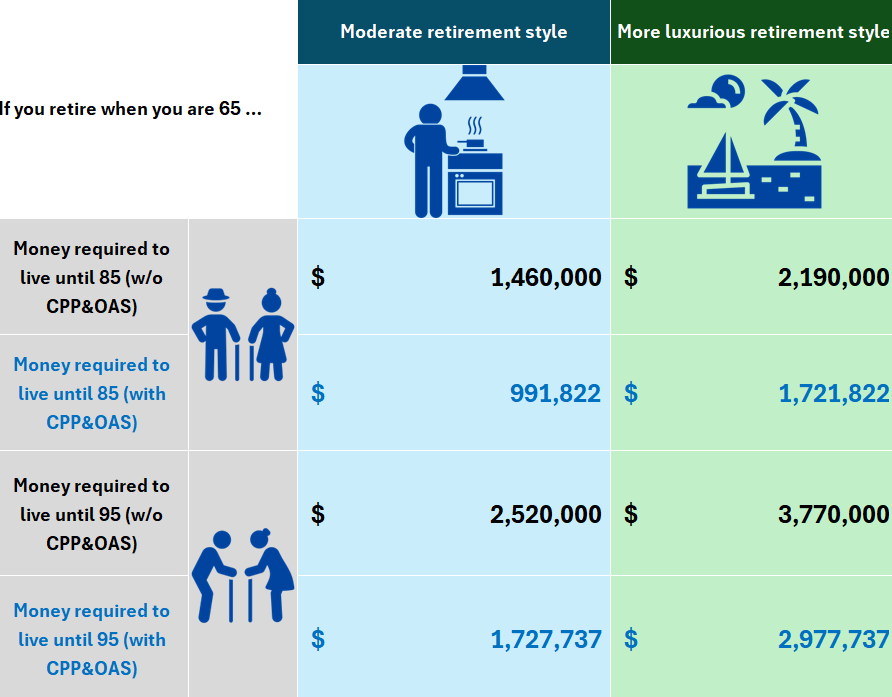

Two-person Family With no Mortgage

In case your family doesn’t have a mortgage to pay, that units you up for much decrease retirement prices. The principle dwelling-related prices that you’ll be on the hook for are property taxes, upkeep prices, further charges (like rubbish charges), and residential insurance coverage.

On this case, your estimated retirement finances might look as follows:

The numbers above are per family, that means that if each companions or spouses are contributing to the family, every of them might contribute from $1.2M (cash required to stay in a reasonable vogue till the age of 85) to $3.4M (cash required to stay in an expensive vogue till the age of 95).

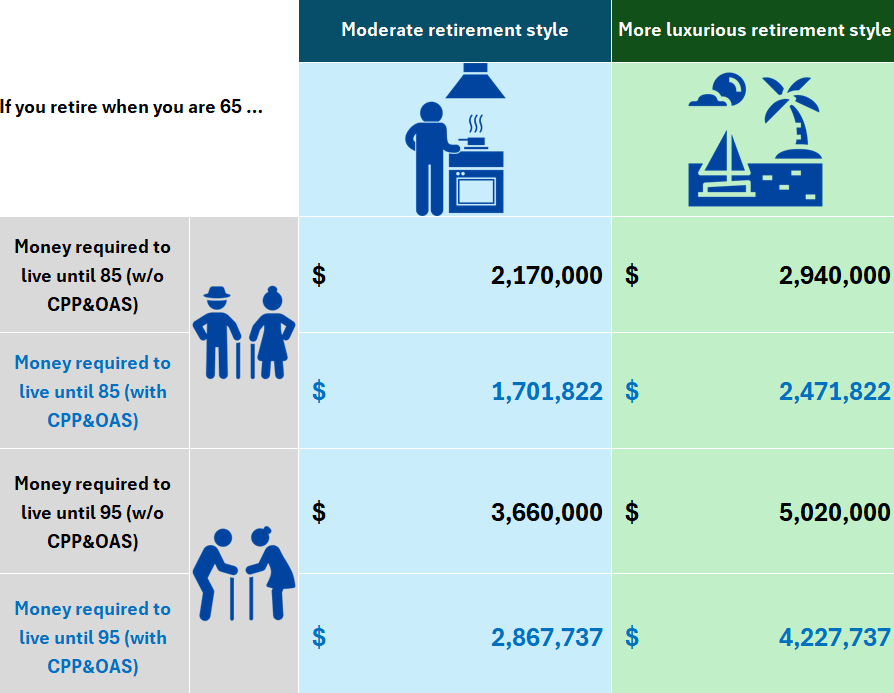

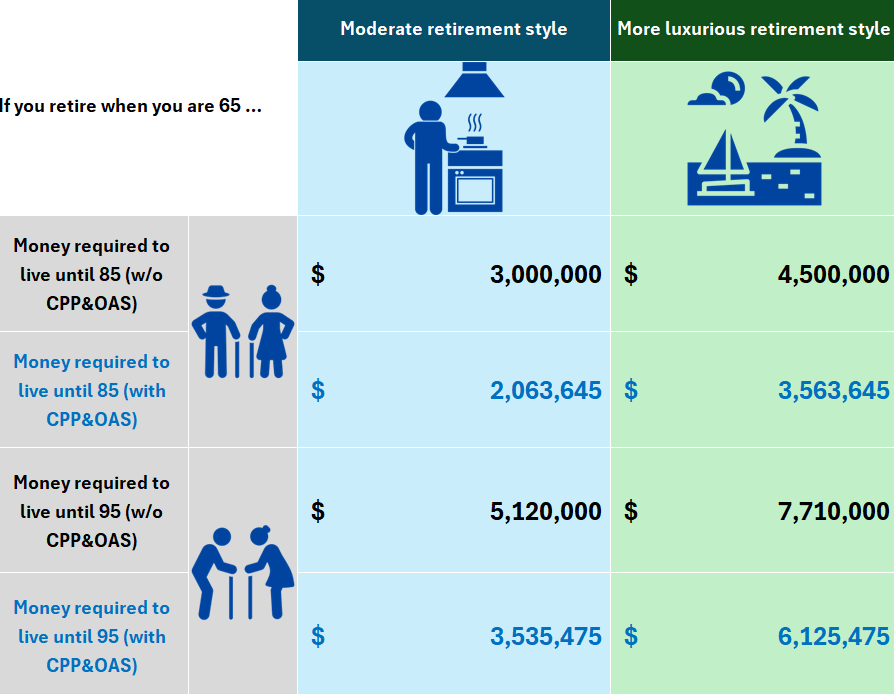

Two-person Family with a Mortgage

If you happen to nonetheless have rather a lot to repay in your mortgage if you find yourself retiring, it’s essential to carry further prices. On this case, you’re including on a median of $2,500/month to your retirement finances.

Your estimated retirement finances will probably be between $3.0M and $4.5M for reasonable and opulent retirement kinds to succeed in age 85 in consolation, and between $5.1M and $7.7M for reasonable and opulent retirement kinds while you plan to stay till the age of 95.

State of affairs 3: Single Particular person Family with a Critical Medical Situation

As folks become old, their well being tends to deteriorate. It comes as no shock that there is perhaps further prices related to sustaining a superb lifestyle for many who expertise critical medical circumstances.

The important thing distinction on this situation as in comparison with the primary one (a single individual) is the medical situation of a retiree that requires him/her to spend further funds on health-related care.

We account for this by including further homecare bills, principally any person who helps with on a regular basis duties like a nurse or a private help employee. That provides round $4,000/month to the finances.

For our train, we contemplate that the complete quantity is paid out of pocket (personal care choice), with none authorities help. Observe that the federal government might provide some further monetary help relying in your case.

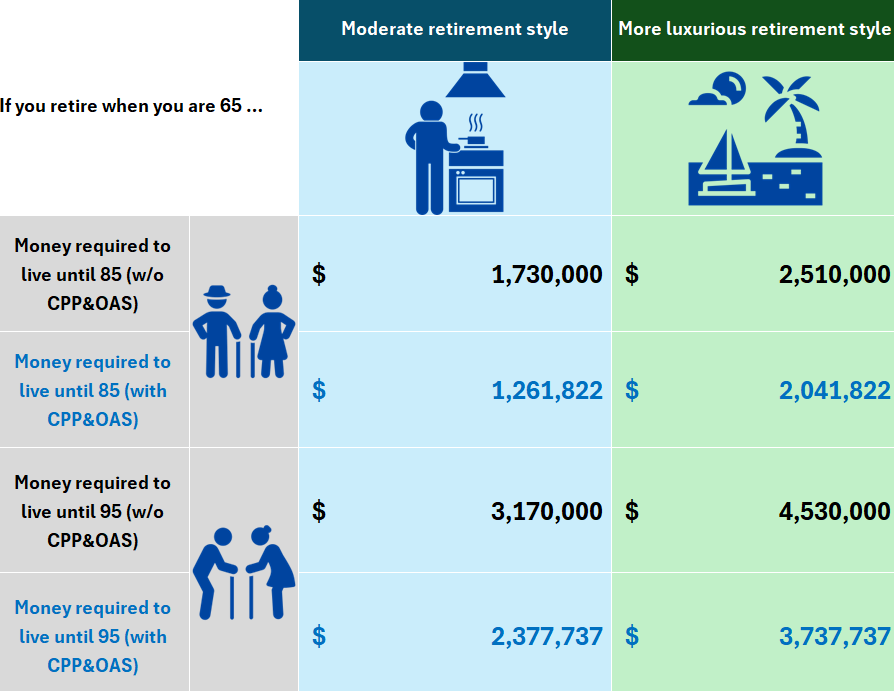

Single Particular person Family with a Critical Medical Situation and With no Mortgage

No mortgage additionally means decrease prices for seniors with medical circumstances, if they will keep in their very own dwelling. The principle dwelling-related prices that you’ll be on a hook for are property taxes, upkeep prices, basic charges (HOA, rubbish, utilities), and residential insurance coverage.

A typical finances on this situation can appear like this:

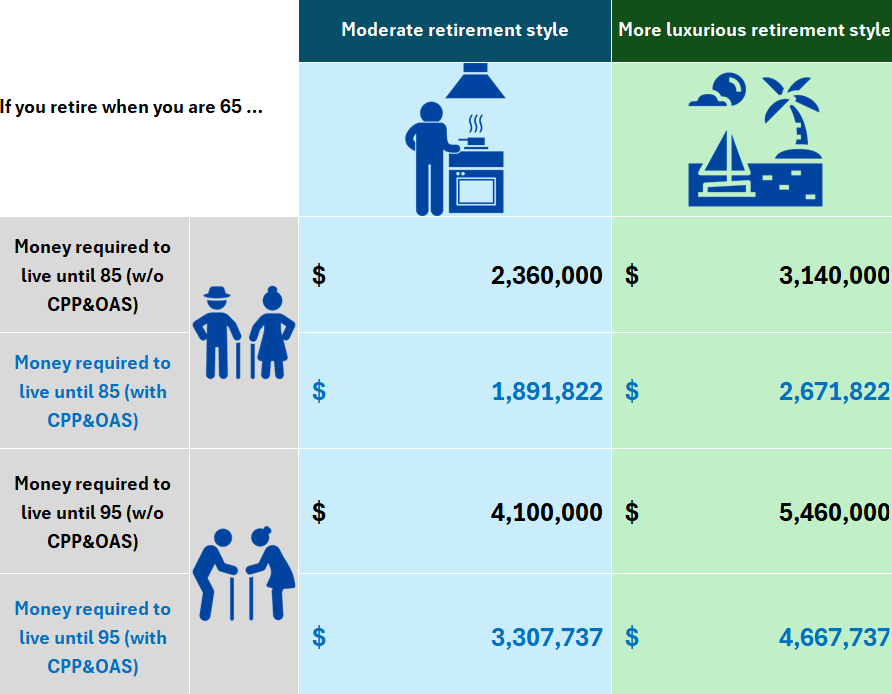

Single Particular person Family with a Critical Medical Situation with a Mortgage

Ought to you might have a substantial mortgage if you find yourself retiring, it’s essential to carry further prices. On this case, you’re including a median of $2,500/month to your retirement finances on high of all of your different bills.

Your estimated retirement finances could possibly be between $2.4M and $3.1M for reasonable and opulent retirement kinds respectively while you plan till the age of 85 and between $4.1M and $5.5M for reasonable and opulent retirement kinds respectively when you stay to the age of 95.

How A lot Cash Do I Must Retire at a Explicit Age?

To reply this query, let’s contemplate a simplified strategy contemplating that if you wish to keep your present way of life it’s essential to plan for 70% of your pre-retirement wage for annually of your life. Must you spend your retirement in a extra luxurious means, dedicating your self to hobbies you might have at all times dreamed of plus permitting your self just a few trip journeys a yr, you’d higher plan in your full pre-retirement earnings (100%) for annually of your life in retirement. The thought is that an extra 30% of bills will be saved from not having work bills (much less wanted for transportation, clothes, and many others.). These funds will be diverted to hobbies, further holidays, and different gadgets of curiosity.

Since salaries fluctuate tremendously; we take just a few choose knowledge factors from 2023:

- Median Canadian Wage: $41,763

- Common Canadian Wage: $63,181

Along with that, we additionally take a look at the numbers when a wage is round $80,000 and $120,000 per yr.

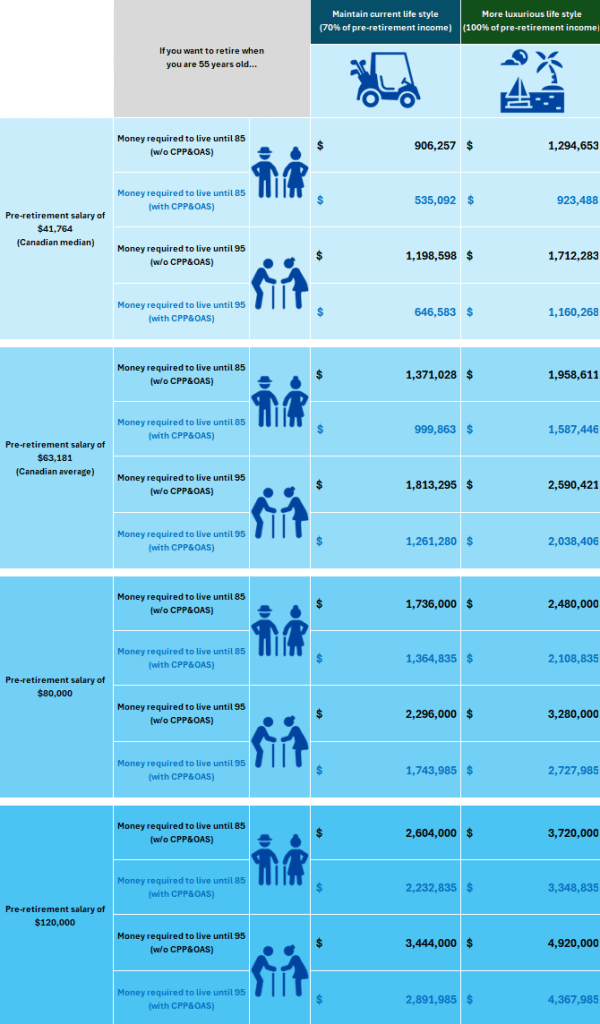

How A lot Cash Do I Must Retire at Age 55?

To retire on the age of 55 whereas having a wage simply shy of $42,000 (once more contemplating the Canadian median earnings of $41,763), you would wish roughly $0.9M to comfortably attain the age of 85 and $1.3M to succeed in 95. Nonetheless, to retire on full pre-retirement earnings, you want roughly $1.2M to succeed in 85 and $1.7M to succeed in 95. Observe that in case your pre-retirement earnings is larger, it is best to plan for larger retirement funds, in response to the desk beneath.

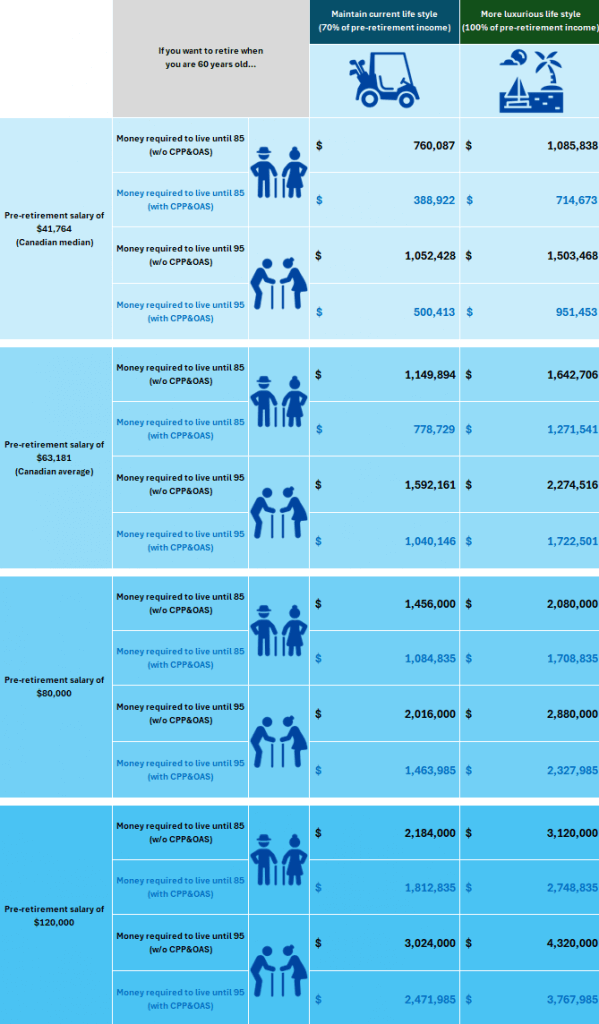

How A lot Cash Do I Must Retire at Age 60?

At age 60, whereas having a wage simply shy of the median at $42,000, you would wish roughly $0.8M to retire at 85 and $1.1M to retire at 95.

If you happen to plan to depend on your full pre-retirement earnings, plan for roughly $1.1M for age 85 and $1.5M for age 95.

Ought to your pre-retirement earnings be larger, let’s say $120,000, you would wish considerably larger pre-retirement funds. If you happen to determine to take care of your present way of life (whereas planning for 70% of your pre-retirement earnings), you’d want $2.2M and $3.0M to stay till 85 and 95 accordingly, or $3.1M and $4.3M to stay till 85 and 95 accordingly.

In case your pre-retirement earnings is larger, then it is best to plan for larger retirement funds, in response to the desk beneath.

How A lot Cash Do You Must Retire with a Explicit Annual Revenue?

Let’s take a look at a simplified strategy contemplating sustaining your present way of life. Right here, it’s essential to plan for 70% of your pre-retirement wage for annually of your life. Must you spend your retirement dwelling in luxurious, plan in your full pre-retirement earnings for annually of your life in retirement.

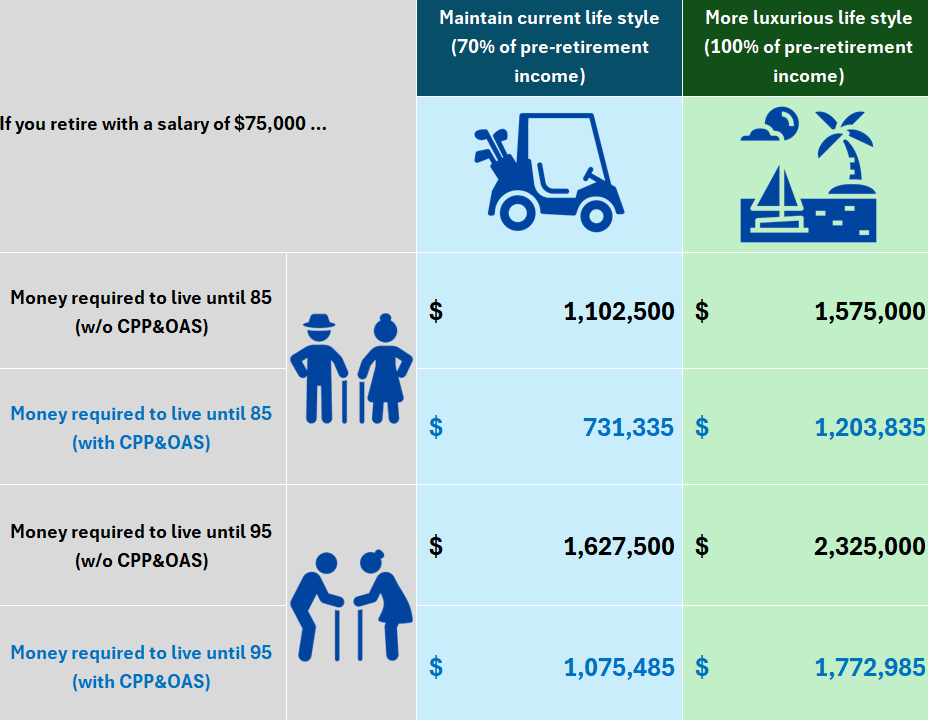

How A lot Cash Do You Must Retire With $75,000 a 12 months Revenue?

To retire at 65 whereas having a wage of $75,000, you want roughly $1.1M when you stay till the age of 85 and $1.6M when you stay till the age of 95. For a full pre-retirement earnings, you would wish roughly $1.6M to comfortably get to 85 and $2.3M to make it to 95 whereas sustaining your present way of life.

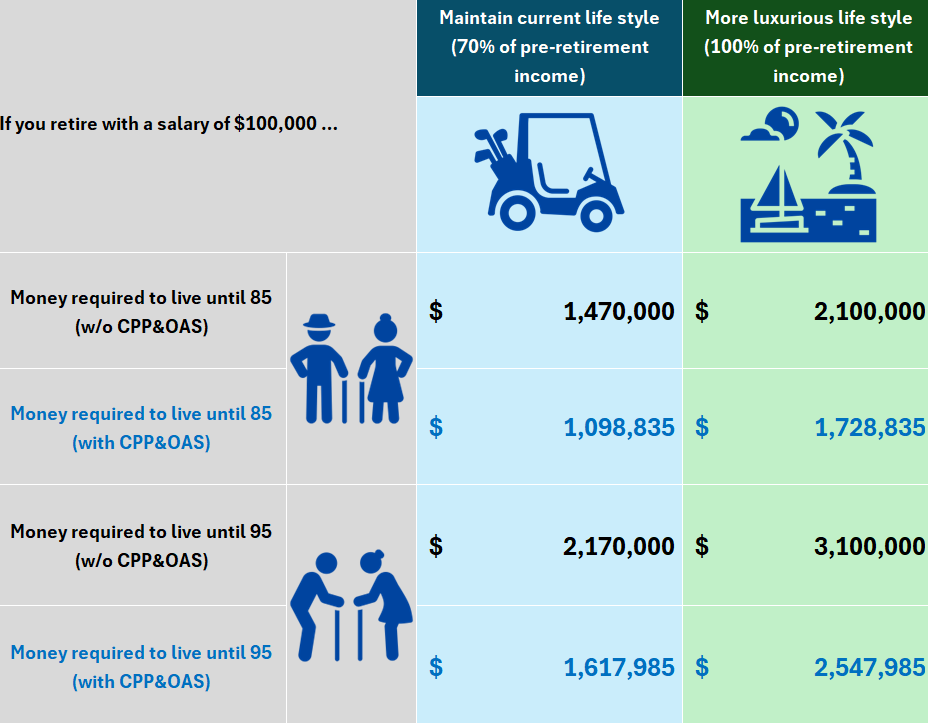

How A lot Cash Do You Must Retire With $100,000 a 12 months Revenue?

To retire at 65 whereas having a wage of $100,000, you want roughly $1.5M when you plan to stay till the age of 85 and $2.1M when you plan to stay till the age of 95. Must you determine to stay retirement in luxurious and depend on a full pre-retirement earnings, you want roughly $2.2M to succeed in the age of 85 and $3.1M to succeed in 95 in consolation.

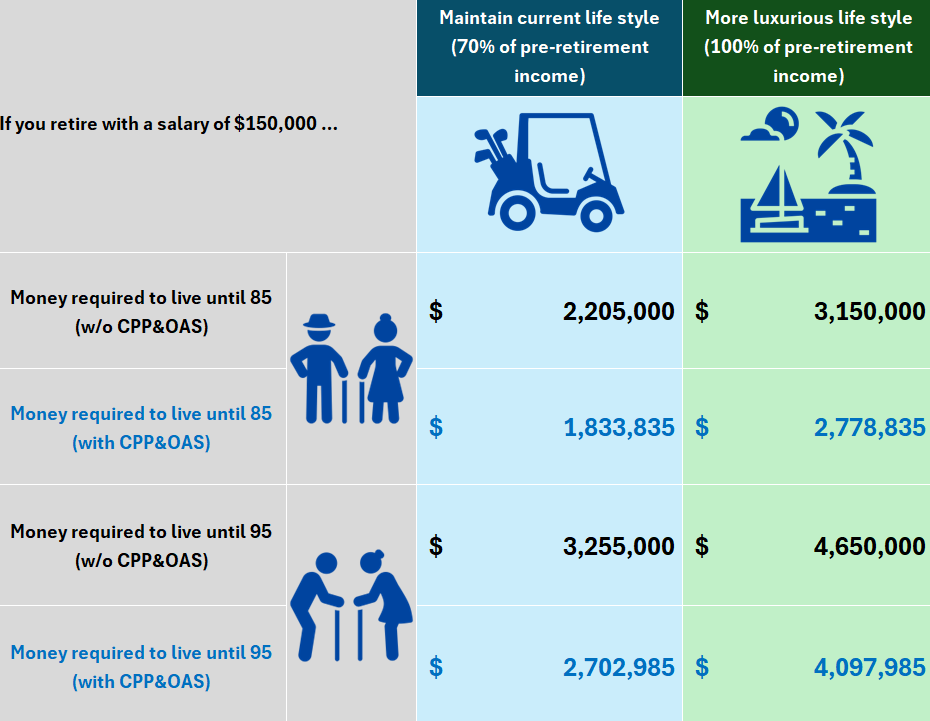

How A lot Cash Do You Must Retire With $150,000 a 12 months Revenue?

To retire at 65 whereas having a wage of $150,000, plan for $2.2M for age 85 and $3.2M for age 95. To depend on your full pre-retirement earnings, you want roughly $3.3M to succeed in age 85 comfortably and $4.7M to succeed in 95.

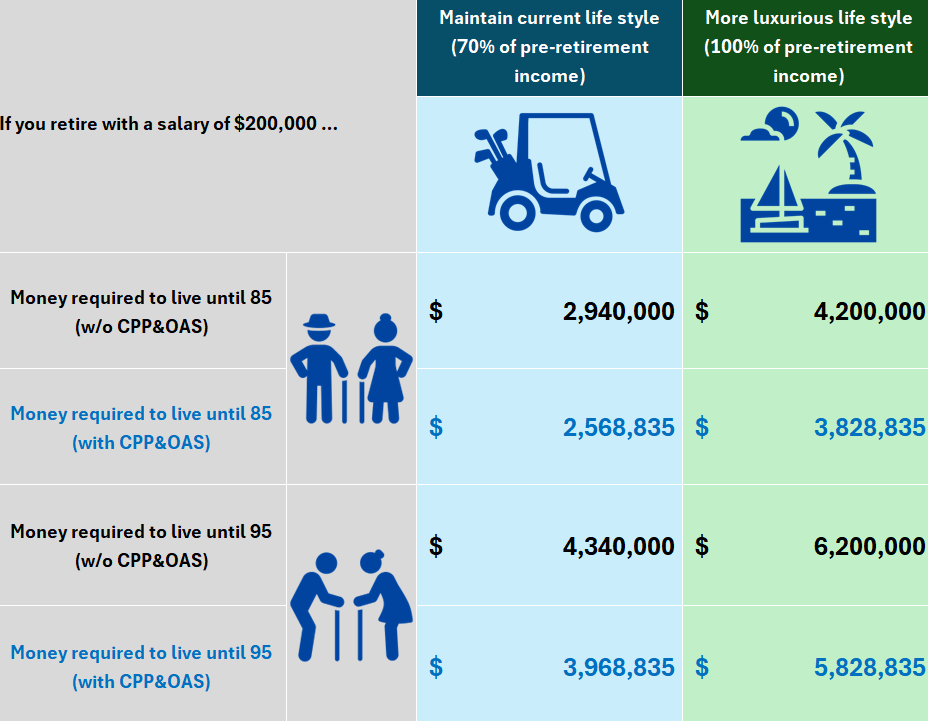

How A lot Cash Do You Must Retire With $200,000 A 12 months Revenue?

To retire at 65 on a wage of $200,000, intention for round $2.9M for age 85 and $4.2M for age 95. If you happen to want your full pre-retirement earnings you want roughly $4.3M when you plan to stay till the age of 85 and $6.2M when you plan to stay till the age of 95.

What Monetary and Insurance coverage Merchandise Can Assist with Retirement Planning?

Each funding and insurance coverage merchandise play a job when planning for sufficient monetary protection for retirement.

| Typical Monetary / Funding merchandise enjoying a job within the retirement | Typical Insurance coverage merchandise enjoying a job within the retirement |

| • Mutual funds • ETFs • RRSPs • TSFAs • Segregated funds |

• Low prices time period insurance coverage for varied functions e.g. last bills, mortgage protection, and many others. • Complete life Insurance coverage common life Insurance coverage • Crucial Sickness Insurance coverage |

Individuals want to take a position in response to their age and supreme wants. These with longer time horizons can and may tackle extra threat to make sure attaining their targets. They need to additionally benefit from making scheduled periodic deposits to their investments to benefit from volatility available in the market.

Mutual funds are an effective way to benefit from skilled administration and ETFs can present an answer for these which are on the lookout for decrease prices.

Additionally, typical monetary merchandise like RRSPs and TFSAs have their function in saving/augmenting your funds whereas leveraging tax alternatives.

As purchasers become old and wish to defend their investments, they will look to segregated funds, which have ensures in-built together with different advantages like bypassing probate by with the ability to title a beneficiary on non-registered holdings.

It’s advisable to work with a monetary advisor who understands your present state of affairs, long-term plans, and has your greatest curiosity at coronary heart.

On the insurance coverage facet, you will need to take a look at each want and money stream.

Some in style options with youthful households are lower-cost time period insurance coverage options to cowl bills (last bills, mortgage, training, and many others.) and earnings alternative in case of the dying of 1 companion.

These slightly older could be everlasting insurance coverage like complete life insurance coverage or common life insurance coverage to make sure family members are taken care of as the possibility of sickness is bigger. Lastly, you possibly can take a look at crucial sickness insurance coverage and incapacity insurance coverage. Crucial sickness is rising in popularity as a result of the possibility of falling ailing with some form of life altering sickness is bigger than ever, particularly as we live longer.

Some extra superior insurance coverage methods, like infinite banking, leverage everlasting insurance coverage insurance policies like one’s personal mini financial institution that you could borrow towards as a substitute of paying larger lending charges to monetary establishments.

Our advisors are very nicely versed in all insurance coverage merchandise to help you with monetary and retirement planning. LSM Insurance coverage (a division of Hub Monetary) works with extra insurance coverage firms than most brokerages. We expect to find out extra about your state of affairs and serving to you propose in your retirement.