By Lewis Nibbelin, Contributing Author, Triple-I

Spanning over 500 miles of the southeastern United States, Hurricane Helene’s path of destruction has drawn public consideration to inland flood threat and the necessity for improved resilience planning and insurance coverage buy (“take up”) to confront the safety hole.

Excessive rainfall and wind inflicted a mix of catastrophic flooding, landslides, and excessive rainfall and wind gusts dumped an unparalleled 40 trillion gallons of water throughout Florida, Georgia, North Carolina, South Carolina, Virginia, and Tennessee, inflicting tons of of deaths and billions in insured losses.

Most losses are concentrated in western North Carolina, with a lot of Buncombe County – dwelling to Asheville and its historic arts district – left just about unrecognizable. Torrential rain and mountain runoff submerged Asheville beneath almost 25 toes of water as rivers swelled, whereas neighboring communities have been equally flattened or swept away.

Rebuilding will take years, particularly as widespread lack of flood insurance coverage forces most victims to hunt federal grants and loans for help, slowing restoration. Compounding these challenges, misinformation about help from the Federal Emergency Administration Company (FEMA) has impeded help operations in sure areas, main FEMA to concern a reality sheet clarifying the truth on the bottom.

A persistent safety hole

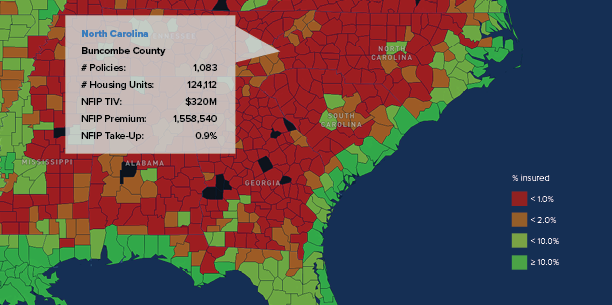

Lower than 1 % of residents in Buncombe County had federal flood insurance coverage as Helene struck, as illustrated within the map beneath, which relies on Nationwide Flood Insurance coverage Program (NFIP) take-up price knowledge. Inland flooding isn’t new, and neither is the inland flood-protection hole.

In August 2021, the Nationwide Climate Service issued its first-ever flash-flood warning for New York Metropolis as remnants of Hurricane Ida introduced rains that flooded subway strains and streets in New York and New Jersey. Greater than 40 folks have been killed in these states and Pennsylvania as basement residences all of the sudden full of water.

Then, in July 2023, a collection of intense thunderstorms resulted in heavy rainfall, lethal flash floods, and extreme river flooding in jap Kentucky and central Appalachia, with hourly rainfall charges exceeding 4 inches over the course of a number of days. Subsequent flooding led to 39 fatalities and federal disaster-area declarations for 13 jap Kentucky counties. Based on FEMA, only some dozen federal flood insurance coverage insurance policies have been in impact within the affected areas earlier than the current storm.

“We’ve seen some fairly vital adjustments within the impression of flooding from hurricanes, very far inland,” Keith Wolfe, Swiss Re’s president for U.S. property and casualty, advised Triple-I CEO Sean Kevelighan in a Triple-I Government Alternate. “Hurricanes have simply behaved very otherwise up to now 5 years, as soon as they arrive on shore, from what we’ve seen up to now 20.”

Want for training and consciousness

Low inland take-up charges largely replicate client misunderstandings about flood insurance coverage. Although roughly 90 % of all U.S. pure disasters contain flooding, many householders are unaware that a typical householders coverage doesn’t cowl flood injury. Equally, many imagine flood protection is pointless until their mortgage lenders require it. It additionally will not be unusual for householders to drop flood insurance coverage protection as soon as their mortgage is paid off to economize.

Greater than half of all householders with flood insurance coverage are coated by NFIP, which is a part of the FEMA and was created in 1968 – a time when few personal insurers have been keen to put in writing flood protection.

Lately, insurers have grown extra snug taking up flood threat, thanks largely to improved knowledge and analytics capabilities. This elevated curiosity in flood amongst personal insurers presents hope for improved affordability of protection at a time when NFIP’s Danger Ranking 2.0 reforms have pushed up flood insurance coverage premium charges for higher-risk property house owners.

New instruments and strategies

New instruments – akin to parametric insurance coverage and community-based disaster insurance coverage – additionally provide methods of bettering flood resilience. Not like conventional indemnity insurance coverage, parametric constructions cowl dangers with out the issues of sending adjusters to evaluate injury after an occasion. As a substitute of paying for injury that has occurred, it pays out if sure agreed-upon circumstances are met – for instance, a particular wind pace or earthquake magnitude in a specific space. If protection is triggered, a fee is made, no matter injury.

Pace of fee and diminished administration prices can ease the burden on each insurers and policyholders. Alone, or as a part of a package deal together with indemnity protection, parametric insurance coverage can present liquidity that companies and communities want for post-catastrophe resilience.

Whereas localized insurance coverage approaches can assist flood resilience, coordinated investments in public training and preemptive mitigation are essential to decreasing threat and making insurance coverage extra out there and reasonably priced. Intergovernmental collaboration with insurers on growth zoning and constructing codes, as an example, can promote the creation of safer and climate-adaptive infrastructure, reducing human and financial losses.

Be taught Extra:

Eradicating Incentives for Growth From Excessive-Danger Areas Boosts Flood Resilience

Miami-Dade, Fla., Sees Flood Insurance coverage Fee Cuts, Due to Resilience Funding

Attacking the Danger Disaster: Roadmap to Funding in Flood Resilience